The latest data from the NASAA 2024 Enforcement Report reinforces the critical role of securities regulators in protecting investors from fraud and financial abuse.

2024 NASAA Enforcement Report Highlights

(Based on 2023 data)

The North American Securities Administrators Association (NASAA) is an international association of state, provincial, and territorial securities regulators in the United States, Canada, and Mexico. These regulators continue to serve as the first, and often the last, line of defense against white-collar crime and financial misconduct targeting the investing public. As we noted in the 2023 Enforcement Report, the pandemic era provided new context for familiar schemes, as bad actors increasingly

turned to the internet and social media to market their investments, and securities offerings involving digital assets continued to become more common. These trends continued over the course of 2023.

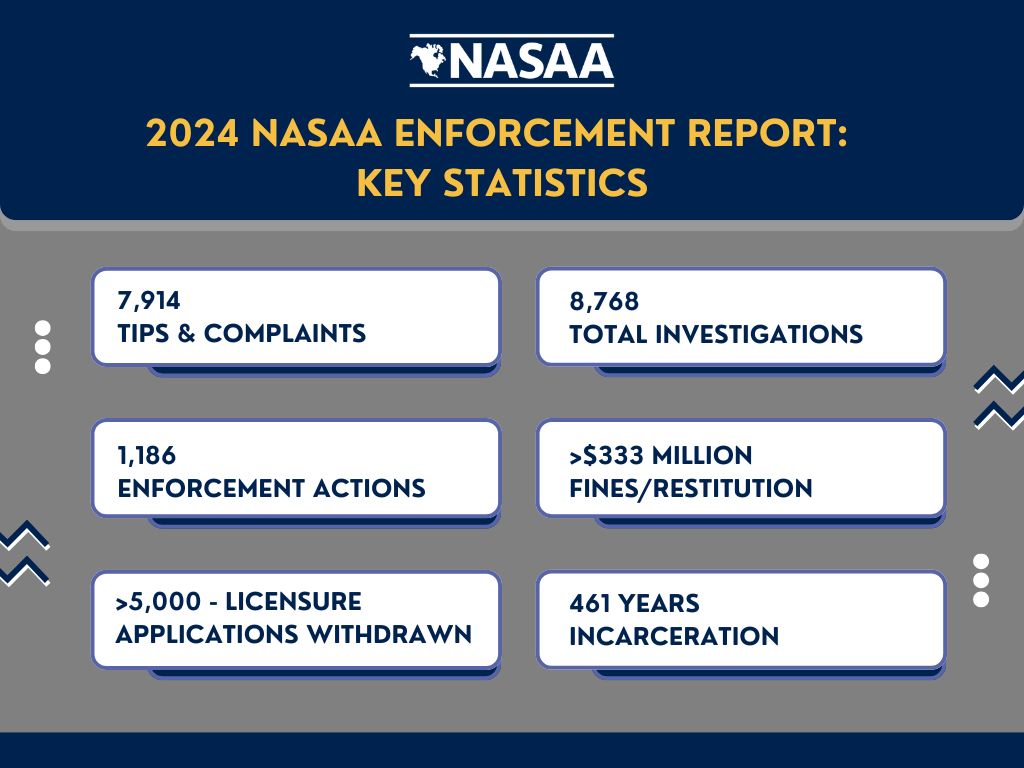

This year’s report reflects the responses of securities regulators in 49 U.S. states and territories covering the 2023 fiscal and calendar years, as well as summary data from securities regulators in the Canadian provinces. In 2023, they investigated 8,768 cases and initiated 1,186 enforcement actions, including 121 criminal actions, 102 civil actions, and 909 administrative actions. Members also secured $208 million in restitution and more than $124 million in fines, as well as approximately 5,531 months in prison sentences and 2,723 months of probation and deferred adjudication. Cumulatively, this data highlights the continued vigilance of NASAA’s members as the local “cops on the beat.” As we emphasized in the 2023 report, the types of activities for which NASAA members took action demonstrate that in a post-pandemic world, the principles underlying state securities laws remain relevant. Although frauds and other illegal offerings may be presented in new wrappers, existing regulatory tools and concepts continue to be effective in protecting investors and maintaining the integrity of our capital markets. In particular, the principles that the United States Supreme Court enunciated in SEC v. W.J. Howey Co. have withstood the test of time. Howey continues to provide a framework that is adaptable to the ever-evolving investment landscape and allows for oversight of the financial pursuits that form the basis of prosperity within our jurisdictions.

In addition to providing enforcement statistics, we will highlight several of the investment schemes common throughout NASAA membership, as well as key enforcement cases from the 2023 fiscal and calendar years. NASAA members pursued many investigations and enforcement actions involving digital assets, staking, and internet and social media fraud, while traditional equities, Ponzi and pyramid schemes, and promissory notes remained among the most commonly cited products and schemes. The data also show that state securities regulators remain proactive in investigating and filing enforcement actions to prevent or stop senior financial exploitation and punish those responsible.

On behalf of the Enforcement Section, thank you for taking an interest in this report. NASAA members are in a unique, and often unfortunate, position to witness conduct in our own “backyards,” often impacting our friends, families, and neighbors. The challenges facing investors are many and evolving, and NASAA and its members will continue working to ensure that all investors are treated fairly.